Have a basket of financing products and services.Opportunity to create work-life balance.Simple process to become a broker with Bankers.No education is required, but you earn more if you can read a balance sheet, purchase order, vendor contract, and supplier agreement.The reasons why becoming an invoice factoring broker makes sense for entrepreneurs:

INVOICE FACTORING BROKER HOW TO

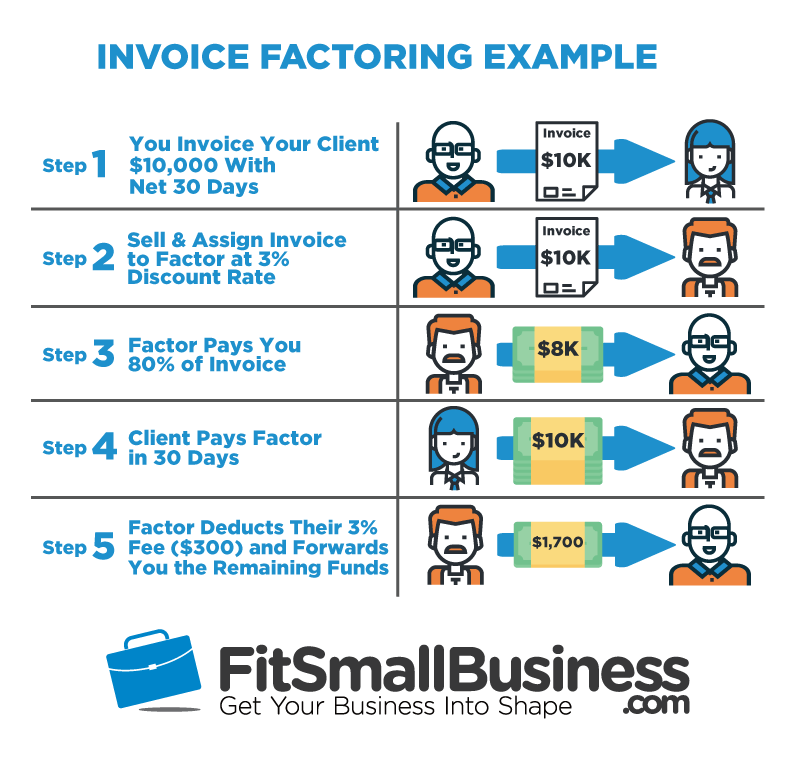

Reasons to Be an Invoice Factoring BrokerĬommercial Finance Brokers can be their own boss and earn six figures a year.Īdditionally, learning how to become an invoice factoring broker or PO Funding ISO is available with the Bankers training program. In contrast, inventory financing is for stocking purposes for retailers or companies that don’t have the order in hand yet. The big difference is Purchase Order funding is for presold goods with firm purchase orders to back them up. PO Funding is also similar to inventory financing. Bankers Factoring also offers purchase order financing for wholesalers and importers to buy finished goods so they can be sold to their B2B or B2G clients. In fact, we have had some clients for over 10 years!įactoring brokers or financial consultants are professionals that connect factoring companies and clients searching to sell their invoices or accounts receivables to accelerate their cash flow and working capital position. Moreover, invoice factoring brokers receive a commission of the financed amount every month for as long as businesses fund with us. We then remove the burden of closing deals and allow you to pursue more deals and grow your brokerage firm. With Bankers Factoring, you locate potential clients and refer them to us. PO Funding to buy finished goods on their behalf.

Clients for invoice factoring brokers typically fall into one of five categories: And as an invoice factoring broker, you help companies arrange financing solutions. Invoice factoring brokers are also known as Independent Sales Organizations (ISO) or business loan brokers. But with the COVID work-from-home transition, and the pressure to come back to the office, the invoice factoring broker opportunity is an enticing and lucrative choice for those who want to be their own boss. In fact, according to Forbes, over fifteen million Americans are self-employed full-time.

INVOICE FACTORING BROKER PROFESSIONAL

“Excellent company, very professional and organized and always quick to respond to any inquiry. So helpful over the phone.” Google Review “Triumph’s team has been a major help to me and my business. Wouldn’t go anywhere else.” Google Review They are always ready and willing to deal with any issues that may come up. I was a little apprehensive about using a factoring company but once I got started and received my first funding I realized that it was the best for my company! Thanks Triumph!” Google Review “Triumph’s service is superb! They have a very easy process to get you started! They were very helpful and professional. There first response with me was like talking to a family member and that hasn’t changed. “I am so thankful that I found a great factoring company like Triumph Business Capital. Also very organized and well laid out plan for helping new customers get started. Customer service is like talking to an old friend.

“This is how everyone should run a business.

0 kommentar(er)

0 kommentar(er)